Biden announces student loan relief

August 24, 2022

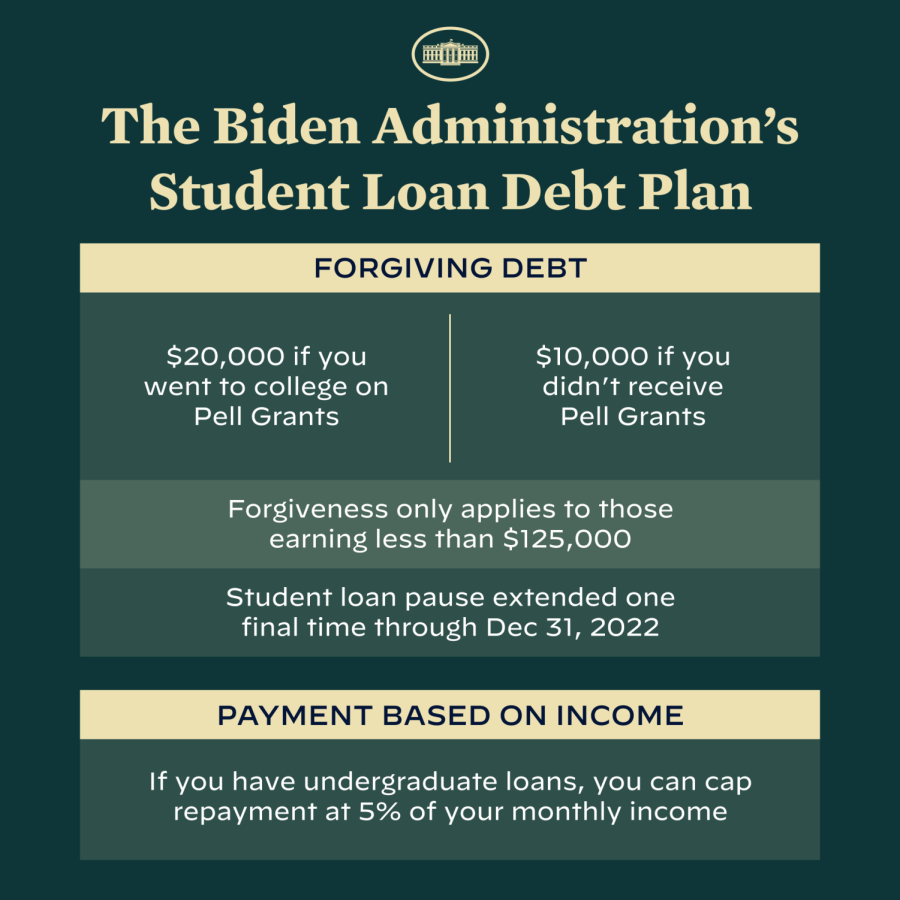

President Joe Biden announced a plan on Aug. 24 to forgive a portion of student loans for some borrowers. With his three-part plan, low- to middle-income borrowers could get $10,000 forgiven, with some qualifying for up to $20,000.

“The cost of education beyond high school has gone up significantly,” Biden said in his public address. “The total cost to attend a public four-year university has nearly tripled in 40 years.”

Instead of increasing funding for public education, Biden noted that most states have cut back on support for public universities, which leaves students with the burden of covering the difference. Some students are rewarded with a Pell Grant, which helps pay for their educational expenses without the burden of having to pay it back afterward. However, these grants no longer give as much relief as they once did.

“Pell Grants used to cover 80% of the cost of going to a public four-year college,” Biden said.

“Today, Pell Grants cover roughly 32%.”

Unable to pay out of pocket for the remainder of their educational expenses, many turn to federal subsidized and unsubsidized student loans to help cover the cost. To help provide some relief to the working class, Biden released his plan to help Americans as they continue to recover from strains associated with the COVID-19 pandemic.

A statement from the White House lays out the key factors to the three-part plan to offer student debt relief:

- Provide targeted debt relief to address the financial harms of the pandemic;

- Make the student loan system more manageable for current and future borrowers;

- Protect future students and taxpayers by reducing the cost of college and holding schools accountable when they hike up the prices.

Eastfield business faculty Emilio Lopez says he supports Biden’s action on loan forgiveness but has concerns about a potential caveat that could affect many borrowers from getting the help being offered. Choosing to transfer some of his federal loans to private lenders to decrease the interest may now make him ineligible for this help.

“It’s unfortunate because I’m still sitting on a hefty balance, and I’m not going to see any of that relief,” Lopez said. “They’ve already been paid well over what I borrowed because I’ve been paying on it for 12 years. So even though I’ve got the interest now to half of what it was with the Department of Education, it’s still a burden.”

Despite the potential for being unaffected by Biden’s loan forgiveness plan, Lopez says it’s about time they did something, but Lopez does not envy the position the president is put in when he must make these decisions.

“It’s amazing how much pushback he’s getting,” Lopez said. “One group says it’s not enough at $10,000 a head, another group says it’s far too much and is going to increase inflation.”

Critics of Biden have been vocal about their response to the news. Senate Minority Leader Mitch McConnell spoke out on Twitter about his disappointment in the decision.

“Democrats’ student loan socialism is a slap in the face to working Americans who sacrificed to pay their debt or made different career choices to avoid debt,” he tweeted. “A wildly unfair redistribution of wealth toward higher-earning people.” His tweet solicited responses from many democratic elected officials refuting his statement and offering their own perspectives in return.

“But it’s really not. It’s not a slap in the face,” Kentucky State Representative Martina Jackson tweeted in response. “I have paid student debt. It’s a step in the right direction. We shouldn’t be going in debt for getting an education.”

The total amount forgiven for some borrowers may only make a small dent, but for some it is an enormous weight they are excited to get rid of. Jake White, a continuing-education student at Eastfield, says he was grateful to read the news. With just over $20,000 in student loan debt left to pay from earning his first bachelor’s degree nine years ago, he looks forward to having his chance to get some relief.

“I think it’s hard to separate student loan forgiveness from other forms of loan forgiveness that we’ve seen in the last two years,” he said. “Why can multimillionaire business owners get loans forgiven but students or former students can’t?”