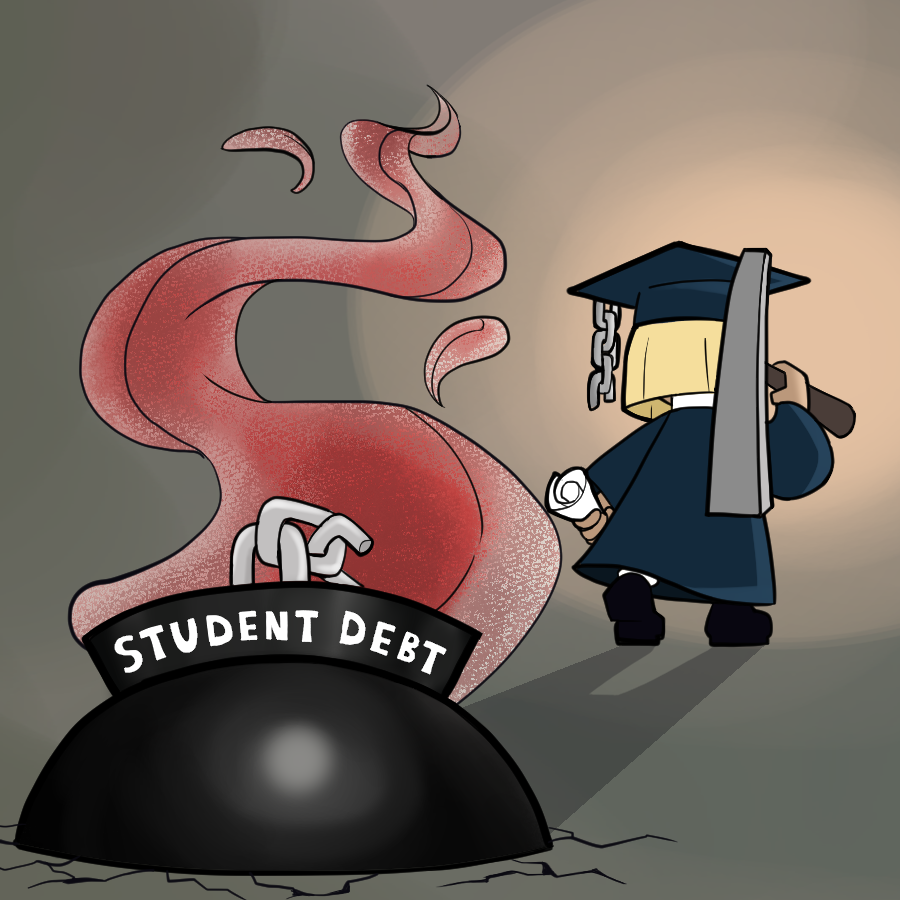

EDITORIAL: Loan forgiveness is a Band-Aid on bigger issue

September 13, 2022

President Joe Biden’s plan for student loan forgiveness is a net positive for college students, but more needs to be done to prevent the issue of crippling student debt from continuing.

The best way to mitigate the student loan crisis is to attack the issue at its source: rising tuition rates and the predatory financial practices that have followed.

Interest rates for federal student loans range from 4.99% to 7.54% depending on degree level. Private loan interest can go as high as 14%. By comparison, the average home loan has an interest rate of 5%. While this might seem comparable, a key difference between these loans is laws set in place forbidding mortgage lenders from setting too low of payments that allow interest to build up.

Student loans commonly offer income-based repayment plans. For new graduates, this is often the only option that makes the monthly payments possible. However, these low payments allow interest to grow. This is then added to the original principal balance, and now interest starts to grow on top of interest. Despite a record of on-time payments, the overall balance continues to grow and hangs over the heads of borrowers.

Biden has placed one final suspension on interest rates that will continue until Dec. 31. Loan payments and collections have also been put on pause until this date. These temporary pauses are meaningful, but it’s imperative to sign student loan regulations into law.

Forgiving up to $20,000 in loans makes an incredible difference for struggling students, but we’ll return to square one if the current administration doesn’t address what initially pushed this issue into fruition.

Currently, student loan debt sits around $1.9 trillion nationwide, but it wasn’t always this way.

The past reality of modestly priced college was due to massive federal funding in education. Legislation such as the National Defense Education Act and Higher Education Act of 1965 created an affordable pathway into higher education.

But major budget cuts since the 1980s sent educational institutions scrambling to offset the deep loss in funding. Increasing the cost of tuition was the solution, and these prices continue to rise to this day.

According to a 2022 report from The College Board, the average annual tuition for an in-state student at a public four-year institution is $27,330. Private four-year institutions average as high as $54,800 per year.

When federal aid doesn’t cover the costs, students are forced to seek out other avenues to make the payments. Predatory loan practices have been the norm since students became desperate to pay for college.

High interest rates combined with crushing financial ramifications trap most students in unavoidable debt.

Inflation and the rising cost of living have pushed colleges and lenders to seek more cash out of students. Combined with living expenses, indebted students make little progress on paying off their loans. Some remain in debt for a substantial portion of their adulthood.

Federal loans help students complete their education with the caveat that their bank accounts are being drained for most of their lives.

Flat forgiveness isn’t enough. No doubt it’s an incredible boon for those struggling with loan debt, especially those with lower amounts owed, but according to a 2021 report by Education Data, the average federal student loan debt is $36,510 per borrower. With the high interest rates attached to these loans, interest will continue to build and payments won’t stop, but the principal balance will hardly be touched.

Even if a total wipe-out legislation of student loan forgiveness was signed into effect immediately, it is only a matter of time before we return to our current state of seemingly never-ending student debt. Without outlawing the predatory practices of these lending institutions, students are destined to struggle to stay afloat in the deep waters of loan repayments for the foreseeable future.

Dallas College prides itself as an affordable institution. With record-low tuition rates, it’s a deal for all within the area. Regardless, many students and faculty here are plagued with crippling student loan debt. We know the current policy offered a clean slate for some, but the tumor needs to be cut – not bandaged.

Partial loan forgiveness is an important first step, and the progress in this area should not go unappreciated. However, we need legislation put into place to protect students in the future. If laws can protect borrowers from exploitative mortgage practices, the same should be done to protect our students.

Voting for politicians that support student loan forgiveness, free college and capping interest rates is the first step the public can take to make sure this problem doesn’t persist.

Student loans should be forgiven, and our presiding administration needs to create the infrastructure to make sure a loan crisis of this magnitude never occurs again.