By Karina Dunn

A Money Expo hosted by OSER and the Accounting Department on March 23-27 sought to help students better manage their finances. Accounting Department Coordinator Professor Regina Brown gave students a few tips on how to master personal accounting during a special presentation for the event.

“Accounting is the core of every major,” Brown said. “If you’re not good at managing your own finances, you cannot manage your share of the budget at work. And you’re less likely to get hired.”

Bank Statements — Bank statements log the money you spend and deposit. Always check your bank account statement to make sure it matches the list of expenses and deposits you have recorded.

Banks make mistakes. You should know if you bought something, the amount of the transaction and which bills you’ve paid. Always review your own records.

Apps – Quicken is one of many free mobile apps that consolidates all your financial information in one place. The software helps users stay organized and within their budgets. When you search for budgeting apps, ensure that the tool is consistent and accurate.

Apps may be convenient, but they are not foolproof. They can crash and can leave off or miss important entries.

Keep a personal ledger and organize your checkbook. Physical checks leave a paper trail that can help you organize your spending.

Paper trail — A paper trail is just another way to record your activity. Be they checks or bank account statements, these documents give you a reference if you ever run into problems or inconsistencies in your account.

Money can easily be stolen or miscounted and it can be difficult to save up, so management skills are important.

Never leave important documents lying around. Class schedules and advising reports list personal information such as social security numbers. Entering information into insecure websites or apps leaves your financial information vulnerable.

At home, be sure to lock away your information. On campus, it’s always more secure to use your student ID number than your social security number.

Visit fightidentitytheft.com to learn more ways to keep your information secure.

Savings — Do not be afraid to save a little at a time. Save your change and deposit it into a container. Do not spend all your money as soon as you get it. Maintain an 80/20 spending habit, spending 80 percent while saving 20 percent.

Bank of America uses the Keep the Change Program to help customers save from everyday purchases.

There are 529 plans available for families who want to save for future college expenses. Almost every state offers these plans. Visit savingforcollege.com.

The Hope Scholarship Credit provides tax credit for children. The Lifetime Learning Credit gives tax credits to adult students.

Each January, certified public accountants and student teachers can help you fill out your tax returns. Getting the help of a CPA volunteer saves time and money. Individuals can also train to become CPAs themselves and learn more about accounting.

Visit irs.gov/Individuals/Free-Tax-Return-Preparation

-for-You-by-Volunteers

”You are students of your money. Study it. Research it,” Brown said.

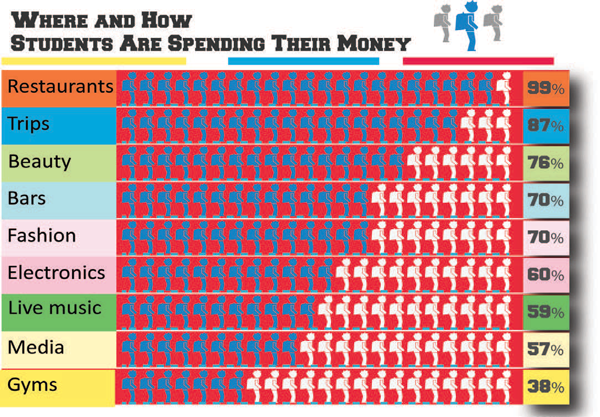

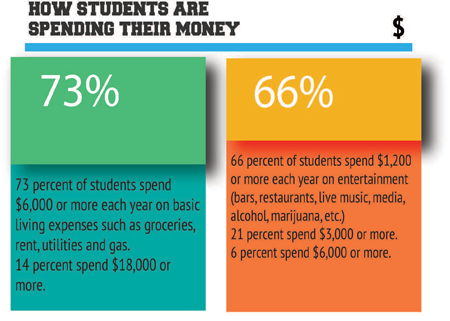

Personal Budget — Many people use personal budgets to control their spending habits. However, it’s easy to overspend.

Choose more affordable options when shopping for clothes. Instead of eating out, learn how to cook. Use coupons. Carpool to avoid spending on bus tickets or gas.

Cutting back on unnecessary expenses will pay off in the long run. Plan ahead.

Change your habits — Buying coffee or lunch every day or paying too much for textbooks are examples of regular habits that cost a lot of money long-term. Change negative spending habits to benefit your wallet.

For example, students rent or borrow books instead of buying them. It takes a little more effort to keep up with due dates and return books, but it is a conscious choice that leads to savings.

Be proactive by making good choices that will cut out excess expenses from the start. Put in the work for a better payoff, then extend these positive habits into areas of personal spending.

“As they lived out the Reality Fair, students were forced to figure out their budgets and how to save,” Brown said. “Some realized they needed to make adjustments and followed through.”

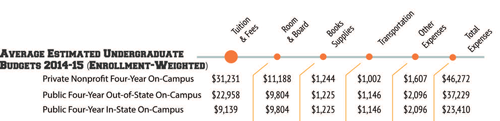

Student loans — When you sign for a loan, sign only for the amount of money you need. Signing for the full loan will create debt that you do not need. Make the smart decision.

Student loans are designed to accumulate interest once students graduate. Accordingdents graduate. If you are accumulating interest during your studies, you have a regular loan, not a student loan. If you’re unsure about what kind of loan you have, read your paperwork.

If you have a regular loan, start paying it off now. Waiting will create additional debt.

Credit unions are the best places to find and manage loans. If you have multiple student loans, use a credit union to consolidate and track them. Request a biweekly repayment schedule to save on interest.

If you take a semester off from school, your student loan will accumulate interest. Contact the credit union via a written letter or with a phone call. Communicate with your bankers to avoid fees.

Making payments while you’re still in school is good because you are paying on what you borrowed, not on interest. Keep all documents for future reference.

“Be a self-starter,” Brown said. “. If you want something to happen, you have to go and get it. Once you have the information, be sure to use it.”

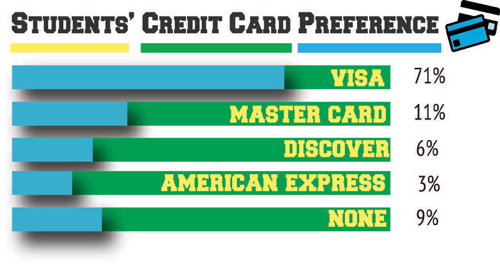

Credit Cards and Credit Scores — Shop around for credit cards. Look for a card that includes an affordable interest rate. Be sure to understand what fees accompany your card.

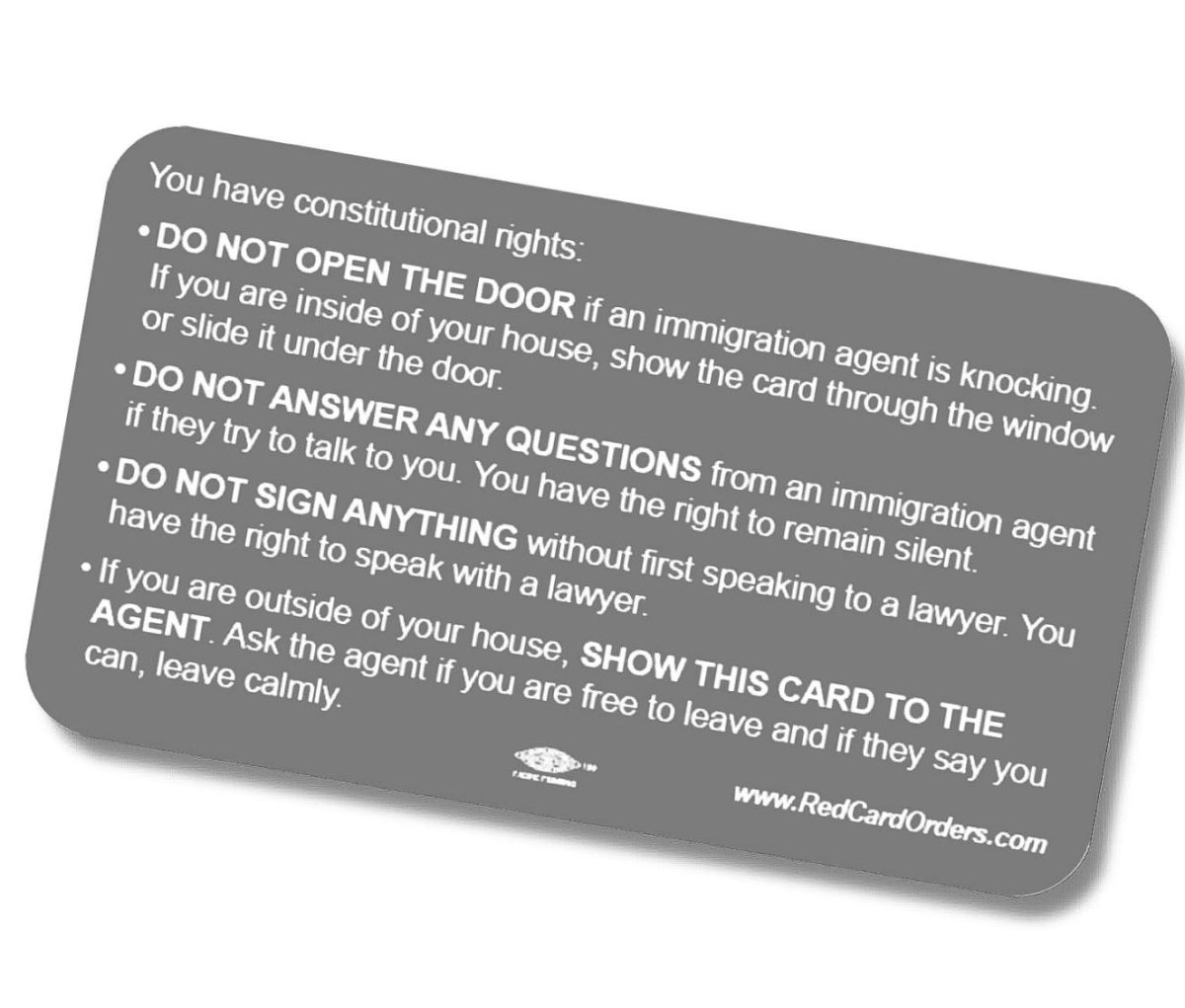

College students often receive credit requests in the mail. Shred them. Destroy all documents containing personal information about you or anyone you know.

If you want to get rid of an active card, freeze it. Do not shred an active card as it can reflect poorly on your credit score. By freezing a credit card, you prevent lenders and borrowers from viewing your credit.

Credit freezes prevent consumers from receiving loans. They can also protect individuals from identity theft. A freeze can be lifted by consumers. Fees may apply.

You are eligible for free credit reports each year. A report includes information about your credit, including bank account information, payment history, how much credit you have.

However, this report does not show your reality.

You may owe a payment to one vendor when two others are listed. These are third parties involved in the transaction after you made your payment. You likely have no direct business with them. Details like these make it important to read through your report.

Follow the legends provided and ask for help if needed.

Visit consumer.ftc.gov to learn more about credit scores and reports.

Visit annualcreditreport.com for free credit reports.

Other resources: federalreserveeducation.org, lowermybills.com.